Pidim stepped into 30 years of its journey towards its goal for amelioration of economic and social status of the poor and marginalized community, since 1995. It often had to travel a dicey and tortuous path and yet not to lose sight to its goal. The progress that it has made so for bears the testimony of organizational capacity to sustain and grow. This report narrates the progress made in fiscal year 2023-24. The operation of Pidim’s microfinance program encompassed 88,939 members under 481 Unions of 69 Upazilas in 16 districts viz. Dhaka, Tangail, Manikganj, Gazipur, Narsingdi, Narayanganj, Munshiganj, Comilla, Sherpur, Mymensingh, Brahmanbaria, Faridpur,Gopalganj, Chandpur, Madaripur and Noakhali In total BDT 8876.11 M was disbursed among 67,659 borrowers belonging to 5,706 Credit and Savings Group (Samity) and at the same time BDT 8010.99 M was realized against the loan. The average loan size was BDT1,14,396 and the rate of On-Time-Realization was 97.21% and Cumulative Rate of Return was 99.20%. The net income from the micro lending operation stood at BDT 149.27 m as on 30 June 2024. The total organizational equity capital as on the date was BDT 1008.81 M and the growth was 17.37% comparing to previous year. Organizational Self Sufficiency was 114.96% and Financial Self Sufficiency 107.36% (year 2024).

More News

২১ ফেব্রুয়ারি মহান শহিদ দিবস ও আন্তর্জাতিক মাতৃভাষা দিবস-২০২৫

২১ফেব্রুয়ারি মহান শহিদ দিবস ও আন্তর্জাতিক মাতৃভাষা দিবস উপলক্ষ্যে পিদিম ফাউন্ডেশনের পক্ষ থেকে কেন্দ্রীয় শহিদ মিনারে পুষ্পস্তবক অর্পণ করা হয়।...

বন্যা দুর্গতদের মাঝে ত্রাণ সামগ্রী ও ঔষুধ বিতরণ ।

আগস্ট,২৪ মাসে আকস্মকি বন্যায় দেশের দক্ষিন র্পূবাঞ্চলের ১১টি জেলার ৭৪ টি উপজেলার প্রায় ৫৬ লক্ষ মানুষ পানিবন্ধী হয়ে পড়ে। বানভাসী পরিবার গুলো খাদ্য...

৫৪-তম মহান স্বাধীনতা ও জাতীয় দিবসও উদ্যাপন করা হয়-২০২৪

অনুরূপভাবে, মাইক্রোক্রেডিট রেগুলেটরী অথরিটি’র (এমআরএ) নির্দেশনা মোতাবেক যথাযোগ্য মর্যাদায় ৫৪-তম মহান স্বাধীনতা ও জাতীয় দিবসও উদ্যাপন করা হয়।...

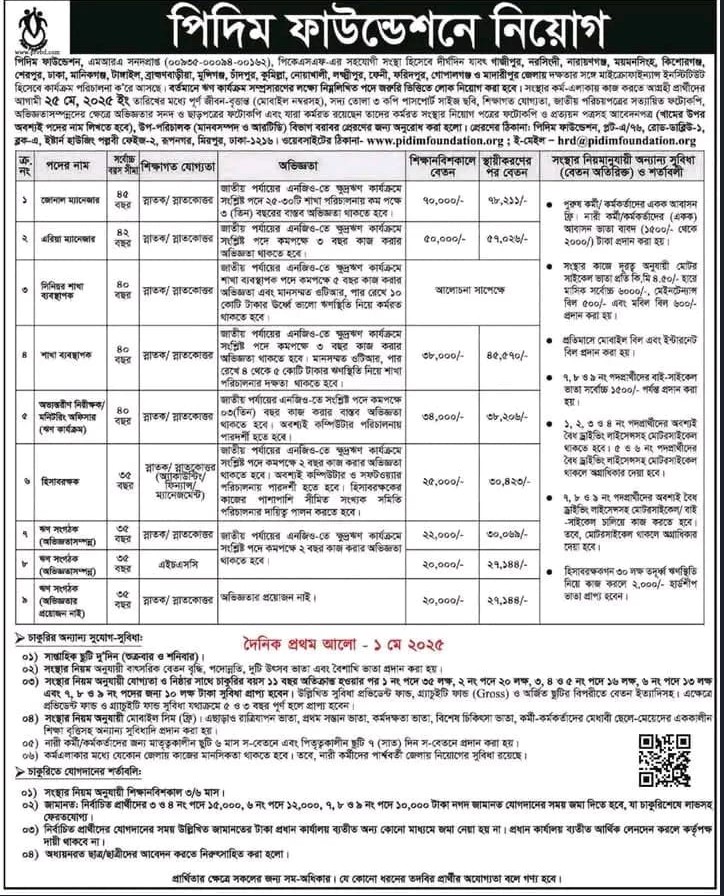

Job Circular May- 2025

Job Circular May- 2025